In order to justify the effort of selecting individual stocks, it’s worth striving to beat the returns from a market index fund. But the risk of stock picking is that you will likely buy under-performing companies. Unfortunately, that’s been the case for longer term Modern Ekonomi Sverige Holding AB (publ) (STO:ME) shareholders, since the share price is down 40% in the last three years, falling well short of the market return of around 38%. The more recent news is of little comfort, with the share price down 30% in a year. Shareholders have had an even rougher run lately, with the share price down 15% in the last 90 days. This could be related to the recent financial results – you can catch up on the most recent data by reading our company report.

See our latest analysis for Modern Ekonomi Sverige Holding

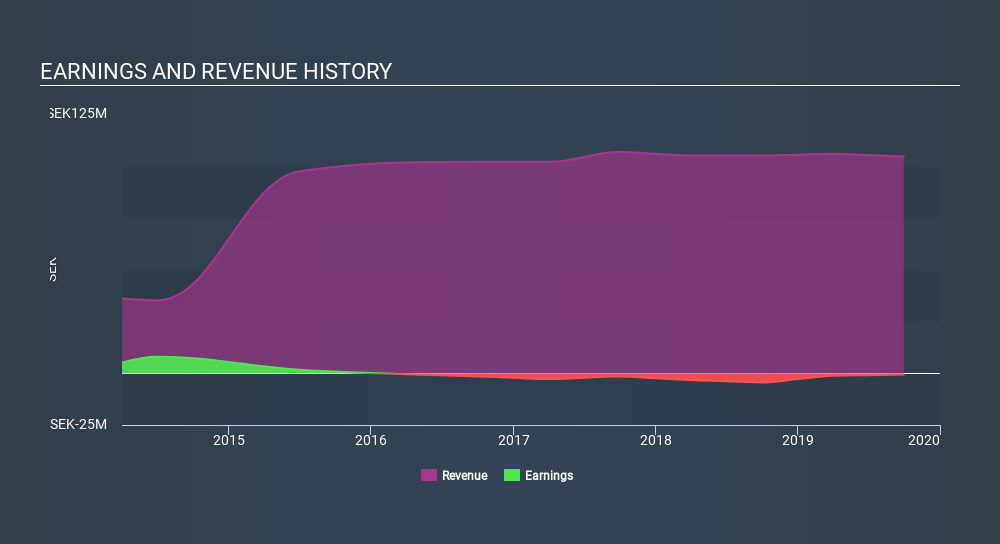

Given that Modern Ekonomi Sverige Holding didn’t make a profit in the last twelve months, we’ll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over three years, Modern Ekonomi Sverige Holding grew revenue at 1.0% per year. That’s not a very high growth rate considering it doesn’t make profits. The stock dropped 16% during that time. If revenue growth accelerates, we might see the share price bounce. But ultimately the key will be whether the company can become profitability.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Take a more thorough look at Modern Ekonomi Sverige Holding’s financial health with this free report on its balance sheet.

A Different Perspective

Modern Ekonomi Sverige Holding shareholders are down 30% for the year, but the market itself is up 32%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year’s performance may indicate unresolved challenges, given that it was worse than the annualised loss of 8.6% over the last half decade. We realise that Buffett has said investors should ‘buy when there is blood on the streets’, but we caution that investors should first be sure they are buying a high quality businesses. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we’ve discovered 4 warning signs for Modern Ekonomi Sverige Holding (of which 2 are major) which any shareholder or potential investor should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SE exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Discounted cash flow calculation for every stock

Simply Wall St does a detailed discounted cash flow calculation every 6 hours for every stock on the market, so if you want to find the intrinsic value of any company just search here. It’s FREE.2020-01-07 09:40:01Z

https://simplywall.st/stocks/se/commercial-services/sto-me/modern-ekonomi-sverige-holding-shares/news/did-changing-sentiment-drive-modern-ekonomi-sverige-holdings-stome-share-price-down-by-40/

CBMiwAFodHRwczovL3NpbXBseXdhbGwuc3Qvc3RvY2tzL3NlL2NvbW1lcmNpYWwtc2VydmljZXMvc3RvLW1lL21vZGVybi1la29ub21pLXN2ZXJpZ2UtaG9sZGluZy1zaGFyZXMvbmV3cy9kaWQtY2hhbmdpbmctc2VudGltZW50LWRyaXZlLW1vZGVybi1la29ub21pLXN2ZXJpZ2UtaG9sZGluZ3Mtc3RvbWUtc2hhcmUtcHJpY2UtZG93bi1ieS00MC_SAcQBaHR0cHM6Ly9zaW1wbHl3YWxsLnN0L3N0b2Nrcy9zZS9jb21tZXJjaWFsLXNlcnZpY2VzL3N0by1tZS9tb2Rlcm4tZWtvbm9taS1zdmVyaWdlLWhvbGRpbmctc2hhcmVzL25ld3MvZGlkLWNoYW5naW5nLXNlbnRpbWVudC1kcml2ZS1tb2Rlcm4tZWtvbm9taS1zdmVyaWdlLWhvbGRpbmdzLXN0b21lLXNoYXJlLXByaWNlLWRvd24tYnktNDAvYW1wLw

Bagikan Berita Ini

0 Response to "Did Changing Sentiment Drive Modern Ekonomi Sverige Holding’s (STO:ME) Share Price Down By 40%? - Simply Wall St"

Post a Comment