In order to justify the effort of selecting individual stocks, it’s worth striving to beat the returns from a market index fund. But in any portfolio, there are likely to be some stocks that fall short of that benchmark. We regret to report that long term Modern Ekonomi Sverige Holding AB (publ) (STO:ME) shareholders have had that experience, with the share price dropping 37% in three years, versus a market return of about 31%. The good news is that the stock is up 4.2% in the last week.

Check out our latest analysis for Modern Ekonomi Sverige Holding

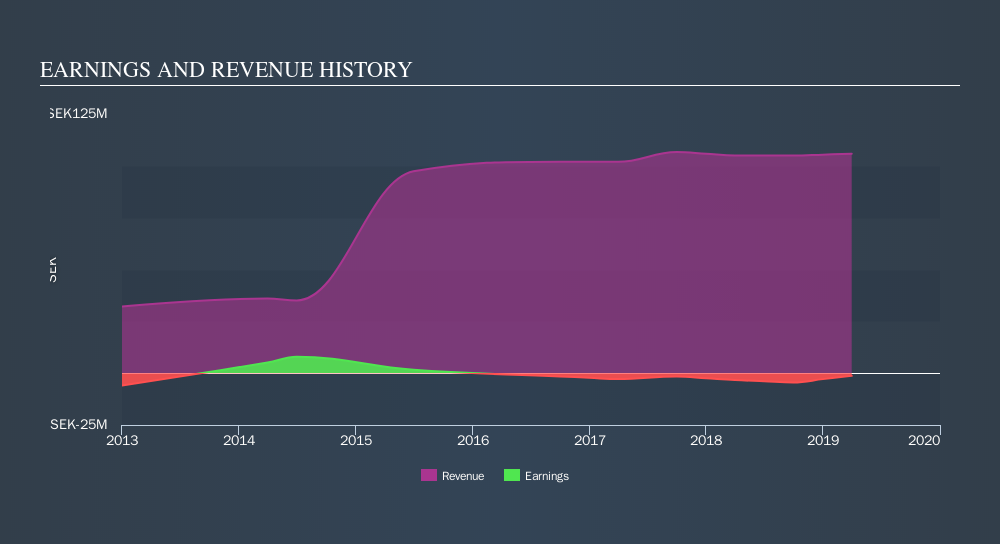

Modern Ekonomi Sverige Holding isn’t currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn’t make profits, we’d generally expect to see good revenue growth. That’s because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on Modern Ekonomi Sverige Holding’s balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Modern Ekonomi Sverige Holding shareholders are down 12% for the year, but the market itself is up 5.9%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year’s performance may indicate unresolved challenges, given that it was worse than the annualised loss of 5.6% over the last half decade. We realise that Buffett has said investors should ‘buy when there is blood on the streets’, but we caution that investors should first be sure they are buying a high quality businesses. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

Of course Modern Ekonomi Sverige Holding may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SE exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

The easiest way to discover new investment ideas

Save hours of research when discovering your next investment with Simply Wall St. Looking for companies potentially undervalued based on their future cash flows? Or maybe you’re looking for sustainable dividend payers or high growth potential stocks. Customise your search to easily find new investment opportunities that match your investment goals. And the best thing about it? It’s FREE. Click here to learn more.2019-09-17 09:29:30Z

https://simplywall.st/stocks/se/commercial-services/sto-me/modern-ekonomi-sverige-holding-shares/news/introducing-modern-ekonomi-sverige-holding-stome-the-stock-that-dropped-37-in-the-last-three-years/

CBMiyQFodHRwczovL3NpbXBseXdhbGwuc3Qvc3RvY2tzL3NlL2NvbW1lcmNpYWwtc2VydmljZXMvc3RvLW1lL21vZGVybi1la29ub21pLXN2ZXJpZ2UtaG9sZGluZy1zaGFyZXMvbmV3cy9pbnRyb2R1Y2luZy1tb2Rlcm4tZWtvbm9taS1zdmVyaWdlLWhvbGRpbmctc3RvbWUtdGhlLXN0b2NrLXRoYXQtZHJvcHBlZC0zNy1pbi10aGUtbGFzdC10aHJlZS15ZWFycy_SAc0BaHR0cHM6Ly9zaW1wbHl3YWxsLnN0L3N0b2Nrcy9zZS9jb21tZXJjaWFsLXNlcnZpY2VzL3N0by1tZS9tb2Rlcm4tZWtvbm9taS1zdmVyaWdlLWhvbGRpbmctc2hhcmVzL25ld3MvaW50cm9kdWNpbmctbW9kZXJuLWVrb25vbWktc3ZlcmlnZS1ob2xkaW5nLXN0b21lLXRoZS1zdG9jay10aGF0LWRyb3BwZWQtMzctaW4tdGhlLWxhc3QtdGhyZWUteWVhcnMvYW1wLw

Bagikan Berita Ini

0 Response to "Introducing Modern Ekonomi Sverige Holding (STO:ME), The Stock That Dropped 37% In The Last Three Years - Simply Wall St"

Post a Comment