By CCN: Kevin Rooke, a financial commentator with a soft spot for bitcoin, tweeted something truly bizarre this week: Tesla appears overvalued if one views it as a car company but undervalued if one views it as a tech company.

If you think Tesla is a car company, it appears overvalued.

If you think Tesla is a tech company, it appears undervalued. pic.twitter.com/bxlfSAXo9N

— Kevin Rooke (@kerooke) May 1, 2019

It doesn’t appear to be an unreasonable thesis at first glance. But delve into it, and you’ll find that it doesn’t matter how one views the Elon Musk-led electric car company. Either way, Tesla stock is still insanely overhyped and overvalued. Yet fund managers just keep pouring money into it.

Tesla Stock: Not All Rainbows and Unicorns

Rooke’s mistake is that he uses Uber and Lyft to establish a baseline for tech company valuations. Neither Uber nor Lyft should be held out as such an example.

Wall Street values both companies at between 7.5x and 7.9x trailing-twelve-month revenue. By comparison, Apple trades at 3.8x, as does Amazon. Both of those companies, however, are incredibly profitable with robust free cash flow.

Uber and Lyft have neither. Therefore, saying that Tesla stock is undervalued because it trades at 1.9x revenue – while it also careens to staggering losses and burns through mountains of cash – is an empty proposition.

Even then, evaluating a company solely on a price-to-sales ratio doesn’t provide a thorough analysis.

Tesla is a Car Producer – Not a Tech Company

And let’s just put the nail in the coffin on this thesis. Tesla is not a tech company. It is a car company.

While Tesla may have some cool technology to support its cars (the ones that work, anyway), that technology is not proprietary, nor is that what the end consumer is purchasing. The consumer is purchasing a car.

Saying that Tesla is a tech company would also imply that all other car manufacturers that are developing electric vehicles or driverless cars are also tech companies.

That’s obviously not the case.

If we look at Rooke’s car company thesis, Tesla stock is not merely overvalued. TSLA stock is valued as a unicorn; unicorns, remember, do not exist. The reason Elon Musk’s company is called a unicorn is because its valuation will never be justified. Ever.

How does Ford, which generated $23 billion in profit over the past four years, not trade at a massive premium to habitual money-loser Tesla? | Source: (i) Shutterstock, (ii) (AP Photo / Kiichiro Sato. Image Edited by CCN.

Forget the price-to-sales ratio. Look at profit and market cap. Ford Motors has generated more than $23 billion in net profit over the past four years. The market values it at $41 billion.

GM has generated more than $35 billion in operating profit over the past four years. The market values it at $55 billion.

Tesla has lost $4.5 billion over the past four years, and the market values it at $41 billion.

If you want proof that Tesla stock is overhyped and insanely overvalued, consider that the market places a value on Tesla that is equivalent to that of Ford Motors.

And Ford vehicles don’t spontaneously combust.

Why Elon Musk Casts Such as Magical Spell Over the Stock Market

That is the power of hype for Tesla. That is the leverage of momentum investing for Elon Musk. That is the dominance that the stock market has over index funds and actively managed funds. Those funds are effectively forced to own Tesla, simply because it is too big and too well-known not to be included in these portfolios.

Momentum and index fund inclusion requirements are the only things that are keeping Tesla stock afloat. As the wheels come off Tesla one nut and bolt at a time and its market cap begins to shrink, there will be less pressure for managers to include Tesla stock in their portfolios.

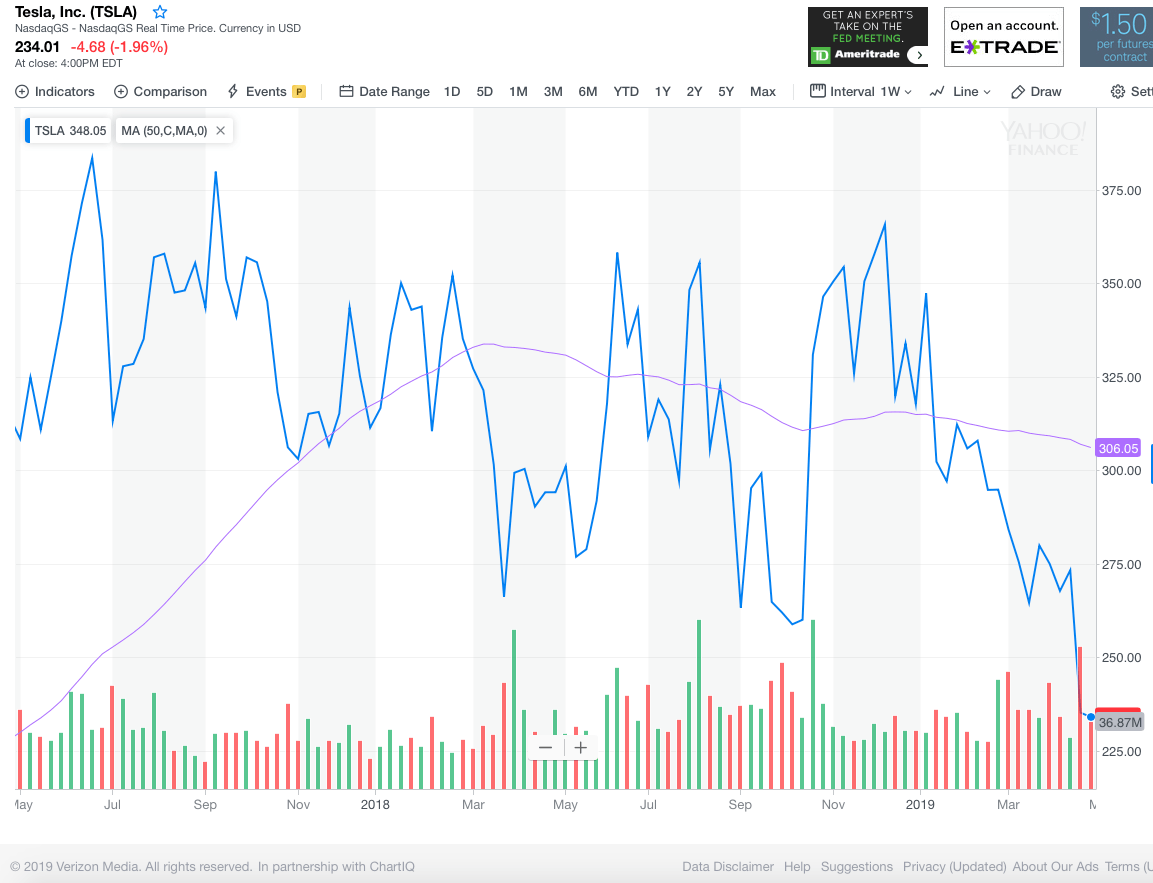

Even now, TSLA shares trade at a two-year low.

https://www.ccn.com/insane-tweet-exposes-how-elon-musk-tesla-hypnotize-investors

2019-05-02 17:55:36Z

52780282026818

Bagikan Berita Ini

0 Response to "Insane Tweet Exposes How Elon Musk & Tesla Hypnotize Investors - CCN"

Post a Comment